A | B | C | D | E | F | G | H | CH | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9

| Conflict resolution |

|---|

| Nonviolence |

| Violence |

| International relations |

| Workplace |

| Other |

An auction is usually a process of buying and selling goods or services by offering them up for bids, taking bids, and then selling the item to the highest bidder or buying the item from the lowest bidder. Some exceptions to this definition exist and are described in the section about different types. The branch of economic theory dealing with auction types and participants' behavior in auctions is called auction theory.

The open ascending price auction is arguably the most common form of auction and has been used throughout history.[1] Participants bid openly against one another, with each subsequent bid being higher than the previous bid.[2] An auctioneer may announce prices, while bidders submit bids vocally or electronically.[2]

Auctions are applied for trade in diverse contexts. These contexts include antiques, paintings, rare collectibles, expensive wines, commodities, livestock, radio spectrum, used cars, real estate, online advertising, vacation packages, emission trading, and many more.

Etymology

The word "auction" is derived from auctus, the past participle of the Latin verb augeō, ("I increase").[1]

History

Classical antiquity

Auctions have been recorded as early as 500 BC.[3] According to Herodotus, in Babylon, auctions of women for marriage were held annually. The auctions began with the woman the auctioneer considered to be the most beautiful and progressed to the least beautiful. It was considered illegal to allow a daughter to be sold outside of the auction method.[4] Attractive maidens were offered in a forward auction to determine the price to be paid by a swain, while unattractive maidens required a reverse auction to determine the price to be paid to a swain.[5]

Auctions took place in Ancient Greece, other Hellenistic societies, and also in Rome.[6] During the Roman Empire, after a military victory, Roman soldiers would often drive a spear into the ground around which the spoils of war were left, to be auctioned off. Slaves, often captured as the "spoils of war", were auctioned in the Forum under the sign of the spear, with the proceeds of sale going toward the war effort.[4]

The Romans also used auctions to liquidate the assets of debtors whose property had been confiscated.[7] For example, Marcus Aurelius sold household furniture to pay off debts, the sales lasting for months.[8] One of the most significant historical auctions was in 193 AD, when the entire Roman Empire was put on the auction block by the Praetorian Guard. On 28 March 193, the Praetorian Guard first killed emperor Pertinax, then offered the empire to the highest bidder. Didius Julianus won the auction at the price of 6,250 drachmas per guard,[clarification needed][9][10][11] an act that initiated a brief civil war. Didius was beheaded two months later when Septimius Severus conquered Rome.[7]

From the end of the Roman Empire to the 18th century, auctions lost favor in Europe,[7] while they had never been widespread in Asia.[4] In China, the personal belongings of deceased Buddhist monks were sold at auction as early as the seventh century AD.[5]

Modern revival

The first mention of "auction", according to the Oxford English Dictionary, appeared in 1595.[5] In some parts of England during the 17th and 18th centuries, auctions by candle began to be used for the sale of goods and leaseholds.[12] In a candle auction, the end of the auction was signaled by the expiration of a candle flame, which was intended to ensure that no one could know exactly when the auction would end and make a last-second bid. Sometimes, other unpredictable events, such as a footrace, were used instead of the expiration of a candle. This type of auction was first mentioned in 1641 in the records of the House of Lords.[13] The practice rapidly became popular, and in 1660 Samuel Pepys' diary recorded two occasions when the Admiralty sold surplus ships "by an inch of candle". Pepys also relates a hint from a highly successful bidder who had observed that, just before expiring, a candle-wick always flares up slightly: on seeing this, he would shout his final – and winning – bid.

The London Gazette began reporting on the auctioning of artwork in the coffeehouses and taverns of London in the late 17th century. The first known auction house in the world was the Stockholm Auction House, Sweden (Stockholms Auktionsverk), founded by Baron Claes Rålamb in 1674.[14][15] Sotheby's, currently the world's second-largest auction house,[14] was founded in London on 11 March 1744, when Samuel Baker presided over the disposal of "several hundred scarce and valuable" books from the library of an acquaintance. Christie's, now the world's largest auction house,[14] was founded by James Christie in 1766 in London[16] and published its first auction catalog that year, although newspaper advertisements of Christie's sales dating from 1759 have been found.[17]

Other early auction houses that are still in operation include Göteborgs Auktionsverk (1681), Dorotheum (1707), Uppsala auktionskammare (1731), Mallams (1788), Bonhams (1793), Phillips de Pury & Company (1796), Freeman's (1805) and Lyon & Turnbull (1826).[18]

By the end of the 18th century, auctions of art works were commonly held in taverns and coffeehouses. These auctions were held daily, and auction catalogs were printed to announce available items. In some cases, these catalogs were elaborate works of art themselves, containing considerable detail about the items being auctioned. At the time, Christie's established a reputation as a leading auction house, taking advantage of London's status as the major centre of the international art trade after the French Revolution. The Great Slave Auction took place in 1859 and is recorded as the largest single sale of enslaved people in U.S. history — with 436 men, women and children being sold.[19] During the American Civil War, goods seized by armies were sold at auction by the Colonel of the division. Thus, some of today's auctioneers in the U.S. carry the unofficial title of "colonel".[8] Tobacco auctioneers in the southern United States in the late 19th century had a style that mixed traditions of 17th century England with chants of slaves from Africa.[20]

Rise of the internet

The development of the internet has led to a significant rise in the use of auctions, as auctioneers can solicit bids via the internet from a wide range of buyers in a much larger variety of commodities than was previously practical.[21] In the 1990s, the multi-attribute auction was invented to negotiate extensive conditions of construction and electricity contracts via auction.[22][23] Also during this time, OnSale.com developed the Yankee auction as its trademark.[24] In the early 2000s, the Brazilian auction was invented as a new type of auction to trade gas through electronic auctions for Linde plc in Brazil.[25][26] With the emergence of the internet, online auctions have developed, with eBay being the most typical example. For example, if someone owns a rare item, they can display the item through an online auction platform. Interested parties may place bids, with the highest bidder winning the opportunity to purchase the item. Online auctions allow more people to participate and also make traditional auction theory more complex.[27]

Economic significance

By increasing visibility of an item and therefore demand, auctions can make an extremely rare item more likely to sell for a higher price.[30]

In 2008, the US National Auctioneers Association reported that the gross revenue of the auction industry for that year was approximately $268.4 billion, with the fastest growing sectors being agricultural, machinery, equipment, and residential real estate auctions.[31]

The auctions with the largest revenue for the government are often spectrum auctions (typical revenue is estimated in billions of euros) and quota auctions. In 2019, Russia's crab quota was auctioned for €2 billion.[32] Between 1999 and 2002, the British government auctioned off their gold reserves, raising approximately $3.5 billion.[33]

The most expensive item to ever be sold in an auction is Leonardo da Vinci's Salvator Mundi in 2017 ($450.3 million).[34]

In 2018, the yearly revenues of the two biggest auction houses were $5 billion (Christie's) and $4 billion (Sotheby's).[35]

Types

Auctions come in a variety of types and categories, which are sometimes not mutually exclusive. Typification of auctions is considered to be a part of Auction theory.[36] The economists Paul Milgrom and Robert B. Wilson were awarded the 2020 Nobel Prize for the introduction of new auction types (or formats).[37] Auction types share features, which can be summarized into the following list.

Participants

| Forward auction | Reverse auction | Double auction |

|---|---|---|

|

|

|

| stand for sellers and for buyers | ||

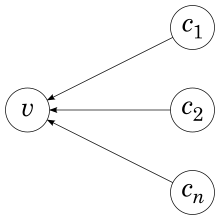

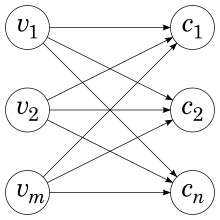

Auctions can differ in the number and type of participants. There are two types of participants: a buyer and a seller. A buyer pays to acquire a certain good or service, while a seller offers goods or services for money or barter exchange. There can be single or multiple buyers and single or multiple sellers in an auction. If just one seller and one buyer are participating, the process is not considered to be an auction.[38][39][40]

| Single Seller | Multiple Sellers | |

|---|---|---|

| Single Buyer | Trade | Reverse auction |

| Multiple Buyers | Forward auction | Double auction |

The forward auction is the most common type of auction — a seller offers item(s) for sale and expects the highest price. A reverse auction is a type of auction in which the roles of the buyer and the seller are reversed, with the primary objective to drive purchase prices downward.[41] While ordinary auctions provide suppliers the opportunity to find the best price among interested buyers, reverse auctions and buyer-determined auctions give buyers a chance to find the lowest-price supplier. During a reverse auction, suppliers may submit multiple offers, usually as a response to competing suppliers' offers, bidding down the price of a good or service to the lowest price they are willing to receive. A reverse price auction is not necessarily 'descending-price' — the reverse Dutch auction is an ascending-price auction because forward Dutch auctions are descending.[42] By revealing the competing bids in real-time to every participating supplier, reverse auctions promote "information transparency". This, coupled with the dynamic bidding process, improves the chances of reaching the fair market value of the item.[43]

A double auction is a combination of both forward and reverse auctions. A Walrasian auction or Walrasian tâtonnement is a double auction in which the auctioneer takes bids from both buyers and sellers in a market of multiple goods.[44] The auctioneer progressively either raises or drops the current proposed price depending on the bids of both buyers and sellers, the auction concluding when supply and demand exactly balance.[45] As a high price tends to dampen demand while a low price tends to increase demand, in theory there is a particular price somewhere in the middle where supply and demand will match.[44] A Barter double auction is an auction where every participant has a demand and an offer consisting of multiple attributes and no money is involved.[46] For the mathematical modelling of satisfaction level, Euclidean distance is used, where the offer and demand are treated as vectors.

Price development

Auctions can be categorized into three types of procedures for auctions depending on the occurrence of a price development[40] during an auction run and its causes.

Driven by bidders only

- English auction, also known as an open ascending price auction. This type of auction is arguably the most common form of auction in use today.[1] Participants bid openly against one another, with each subsequent bid required to be higher than the previous bid.[2] An auctioneer may announce prices, bidders may call out their bids themselves (or have a proxy call out a bid on their behalf), or bids may be submitted electronically with the highest current bid publicly displayed.[2] In some cases a maximum bid might be left with the auctioneer, who may bid on behalf of the bidder according to the bidder's instructions.[2] The auction ends when no participant is willing to bid further, at which point the highest bidder pays their bid.[2] Alternatively, if the seller has set a minimum sale price in advance (the 'reserve' price) and the final bid does not reach that price the item will remain unsold.[2] Sometimes the auctioneer sets a minimum amount, sometimes known as a bidding increment, by which the next bid must exceed the current highest bid.[2] The most significant distinguishing factor of this auction type is that the current highest bid is always available to potential bidders,[2] although at that time there may be higher absentee bids held by the auctioneer which are not known to potential bidders. The English auction is commonly used for selling goods, most prominently antiques and artwork,[2] but also secondhand goods and real estate.

- Auction by the candle. A type of auction, used in England for selling ships, in which the highest bid laid on the table wins after a burning candle goes out.

- Scottish auction is an auction where all bidding should be completed within a certain time interval, which allows bidders an appropriate amount of time for consideration and avoids precipitate actions.[47]

Partially driven by time

- Dutch auction also known as an open descending price auction.[1] In the traditional Dutch auction the auctioneer begins with a high asking price for some quantity of like items; the price is lowered until a participant is willing to accept the auctioneer's price for some quantity of the goods in the lot or until the seller's reserve price is met.[2] If the first bidder does not purchase the entire lot, the auctioneer continues lowering the price until all of the items have been bid for or the reserve price is reached. Items are allocated based on bid order; the highest bidder selects their item(s) first followed by the second highest bidder, etc. In a modification, all of the winning participants pay only the last announced price for the items that they bid on.[1] The Dutch auction is named for its best known example, the Dutch tulip auctions. ("Dutch auction" is also sometimes used to describe online auctions where several identical goods are sold simultaneously to an equal number of high bidders).[48] In addition to cut flower sales in the Netherlands, Dutch auctions have also been used for perishable commodities such as fish and tobacco.[2] The Dutch auction is not widely used, except in market orders in stock or currency exchanges, which are functionally identical.[1]

- Japanese auction is a variation of the Dutch auction with a low initial price that increases over time. As the price rises, participants must either signal intent to continue bidding or drop out of the auction, and no participant may enter or re-enter the auction once it has begun. Once only one participant remains in the auction, the auction ends and that participant wins the item at the current price. It has similarities to the ante in Poker.[49]

Single shot

- First-price sealed-bid auction,[50] or a sealed-bid first-price auction/blind auction, is a type of auction where all bidders simultaneously submit sealed bids so that no bidder knows the bid of any other participant. The highest bidder pays the price they submitted.[1][2] This type of auction is distinct from the English auction, in that bidders can only submit one bid each. Furthermore, as bidders cannot see the bids of other participants they cannot adjust their own bids accordingly.[2] From the theoretical perspective, this kind of bid process has been argued to be strategically equivalent to the Dutch auction.[51] However, empirical evidence from laboratory experiments has shown that Dutch auctions with high clock speeds yield lower prices than FPSB auctions.[52][53] What are effectively sealed first-price auctions are commonly called tendering for procurement by companies and organisations, particularly for government contracts and auctions for mining leases.[2]

- Vickrey auction, also known as a sealed-bid second-price auction.[54] This is identical to the sealed first-price auction except that the winning bidder pays the second-highest bid rather than their own.[55] Vickrey auctions are extremely important in auction theory, and commonly used in automated contexts such as real-time bidding for online advertising, but rarely in non-automated contexts.[2]

Properties of auctioned goods

Multiunit auctions sell more than one identical item at a time, rather than having separate auctions for each. This type can be further classified as either a uniform price auction or a discriminatory price auction. An example for them is spectrum auctions.

A combinatorial auction is any auction for the simultaneous sale of more than one item where bidders can place bids on an "all-or-nothing" basis on "packages" rather than just individual items. That is, a bidder can specify that they will pay for items A and B, but only if they get both.[56] In combinatorial auctions, determining the winning bidder(s) can be a complex process where even the bidder with the highest individual bid is not guaranteed to win.[56] For example, in an auction with four items (W, X, Y and Z), if Bidder A offers $50 for items W & Y, Bidder B offers $30 for items W & X, Bidder C offers $5 for items X & Z and Bidder D offers $30 for items Y & Z, the winners will be Bidders B & D while Bidder A misses out because the combined bids of Bidders B & D is higher ($60) than for Bidders A and C ($55). Deferred-acceptance auction is a special case of a combinatorial auction.[57]

Another special case of a combinatorial auction is the combinatorial clock auction (CCA), which combines a clock auction, during which bidders may provide their confirmations in response to the rising prices, with a subsequantial sealed bid auction, in which bidders submit sealed package bids. The auctioneer uses the final bids to compute the best value allocation and the Vickrey payments.[58][59]

Generalized first-price auctions and Generalized second-price auctions offer slots for multiple bidders instead of making a single deal. The bidders get the slots according to the ranking of their bids. The second-price ruling is derived from the Vickrey auction and means the final deal sealing for the number one bidder is based on the second bidder's price.

Reserve price

A No-reserve auction (NR), also known as an absolute auction, is an auction in which the item for sale will be sold regardless of price.[60][61] From the seller's perspective, advertising an auction as having no reserve price can be desirable because it potentially attracts a greater number of bidders due to the possibility of a bargain.[60] If more bidders attend the auction, a higher price might ultimately be achieved because of heightened competition from bidders.[61] This contrasts with a reserve auction, where the item for sale may not be sold if the final bid is not high enough to satisfy the seller. In practice, an auction advertised as "absolute" or "no-reserve" may nonetheless still not sell to the highest bidder on the day, for example, if the seller withdraws the item from the auction or extends the auction period indefinitely,[62] although these practices may be restricted by law in some jurisdictions or under the terms of sale available from the auctioneer.

A reserve auction is an auction where the item for sale may not be sold if the final bid is not high enough to satisfy the seller; that is, the seller reserves the right to accept or reject the highest bid.[61] In these cases, a set 'reserve' price known to the auctioneer, but not necessarily to the bidders, may have been set, below which the item may not be sold.[60] If the seller announces to the bidders the reserve price, it is a public reserve price auction.[63] In contrast, if the seller does not announce the reserve price before the sale, it is a secret reserve price auction.[64] However, potential bidders may be able to deduce an approximate reserve price, if one exists at all, from any estimate given in advance by the auction house. The reserve price may be fixed or discretionary. In the latter case, the decision to accept a bid is deferred to the auctioneer, who may accept a bid that is marginally below it. A reserve auction is safer for the seller than a no-reserve auction as they are not required to accept a low bid, but this could result in a lower final price if less interest is generated in the sale.[61]

Price of bidding

An all-pay auction is an auction in which all bidders must pay their bids regardless of whether they win. The highest bidder wins the item. All-pay auctions are primarily of academic interest, and may be used to model lobbying or bribery (bids are political contributions) or competitions such as a running race.[65] Bidding fee auction, a variation of all-pay auction, also known as a penny auction, often requires that each participant must pay a fixed price to place each bid, typically one penny (hence the name) higher than the current bid. When an auction's time period expires, the highest bidder wins the item and must pay a final bid price.[66] Unlike in a conventional auction, the final price is typically much lower than the value of the item, but all bidders (not just the winner) will have paid for each bid placed; the winner will buy the item at a very low price (plus price of rights-to-bid used), all the losers will have paid, and the seller will typically receive significantly more than the value of the item.[67] A senior auction is a variation on the all-pay auction, and has a defined loser in addition to the winner. The top two bidders must pay their full final bid amounts, and only the highest wins the auction. The intent is to make the high bidders bid above their upper limits. In the final rounds of bidding, when the current losing party has hit their maximum bid, they are encouraged to bid over their maximum (seen as a small loss) to avoid losing their maximum bid with no return (a very large loss). Another variation of all-pay auction, the top-up auction is primarily used for charity events. Losing bidders must pay the difference between their bid and the next lowest bid. The winning bidder pays the amount bid for the item, without top-up. In a Chinese auction, bidders make sealed bids in advance and their probability of winning grows with the relative size of their bids.[68]

Structure of a bid

In usual auctions like the English one, bids are prices. In Dutch and Japanese auctions, the bids are confirmations. In a version of the Brazilian auction, bids are numbers of units being traded. Structure elements of a bid are called attributes. If a bid is one number like price, it is a single-attribute auction. If bids consists of multiple-attributes, it is a multi-attribute auction.[69][70]

A Yankee auction is a single-attribute multiunit auction running like a Dutch auction, where the bids are the portions of a total amount of identical units.[71][72][73] The amount of auctioned items is firm in a Yankee auction unlike a Brazilian auction. The portions of the total amount, bidders can bid, are limited to lower numbers than the total amount. Therefore, only a portion of the total amount will be traded for the best price and the rest to the suboptimal prices.

Visibility of bids

In an English auction, all current bids are visible to all bidders and in a sealed-bid auction, bidders only get to know if their bid was the best. Best/not best auctions are sealed-bid auctions with multiple bids, where the bidders submit their prices like in English auction and get responses about the leadership of their bid.[74] Rank auction is an extension of best/not best auction, where the bidders also see the rank of their bids.[75] Traffic-light auction shows traffic lights to bidders as a response to their bids.[76] These traffic lights depend on the position of the last bid in the distribution of all bids.

Buyout option

A buyout auction is an auction with an additional set price (the 'buyout' price) that any bidder can accept at any time during the auction, thereby immediately ending the auction and winning the item. This means that if an item offers its buyout price at the beginning, one participant can stop all other potential participants from bidding at all, or stop the bidding process before the bid price has reached the buyout price.[77] If no bidder chooses to utilize the buyout option before the end of bidding, the highest bidder wins and pays their bid.[77] Buyout options can be either temporary or permanent.[77] In a temporary-buyout auction the option to buy out the auction is not available after the first bid is placed.[77] In a permanent-buyout auction the buyout option remains available throughout the entire auction until the close of bidding.[77] The buyout price can either remain the same throughout the entire auction, or vary throughout according to rules or simply as decided by the seller.[77]

Winner selection

The winner selection in most auctions selects the best bid. Unique bid auctions offer a special winner selection.[78] The winner is the bidder with the lowest unique bid. The Chinese auction selects a winner partially based on random.[68]

The final price for the selected winner is not always conducted according to their final bid. In the case of the second-price ruling as in a Vickrey auction, the final price for the winner is based on the second bidder's price. A Proxy bid is a special case of second-price ruling used by eBay, where a predefined increment is added to the second highest bid in response to a yet higher bid.

Auctions with more than one winner are called multi-winner auctions.[79] Multiunit auction, Combinatorial auction, Generalized first-price auction and Generalized second-price auction are multi-winner auctions.

Cascading

Auctions can be cascaded, one after the other. For instance, an Amsterdam auction is a type of premium auction which begins as an English auction. Once only two bidders remain, each submits a sealed bid. The higher bidder wins, paying either the first or second price. Both finalists receive a premium: a proportion of the excess of the second price over the third price (at which English auction ended).[80] An Anglo-Dutch auction starts as an English or Japanese auction and then continues as a Dutch auction with a reduced number of bidders.[81][82] A French auction is a preliminary sealed-bid auction before the actual auction, whose reserve price it determines. A sequential auction is an auction where the bidders can participate in a sequence of auctions. A Calcutta auction is a subtype of sequential auction, where the ordering in the sequence is determined by random.[83] A simultaneous ascending auction is an opposite of a sequential auction, where the auctions are run in parallel.[84]

Other features

The Silent auction is a variant of the English auction in which bids are written on a sheet of paper. At the predetermined end of the auction, the highest listed bidder wins the item.[85] This auction is often used in charity events, with many items auctioned simultaneously and "closed" at a common finish time.[85][86] The auction is "silent" in that there is no auctioneer selling individual items,[85] the bidders writing their bids on a bidding sheet often left on a table near the item.[87] At charity auctions, bid sheets usually have a fixed starting amount, predetermined bid increments, and a "guaranteed bid" amount which works the same as a "buy now" amount. Other variations of this type of auction may include sealed bids.[85] The highest bidder pays the price they submitted.[85]

In private value auctions, every bidder has their own valuation of the auctioned good.[88] A common value auction is opposite, where the valuation of the auctioned good is identical among the bidders.

Contexts

The range of auctions' contexts is extremely wide and one can buy almost anything, from a house to an endowment policy and everything in between. Some of the recent developments have been the use of the Internet both as a means of disseminating information about various auctions and as a vehicle for hosting auctions themselves.

Human commodity auctions

As already mentioned in the history section, auctions have been used to trade commodified people from the very first. Auctions have been used in slave markets throughout history until modern times in the post-Gaddafi era Libya.[89][90][91] The word for slave auction in the Atlantic slave trade was scramble. A child auction is a Swedish and Finnish historical practice of selling children into slavery-like conditions by authorities using a descending English auction.[92] Fattigauktion is a similar Swedish practice involving poor people being auctioned to church organizations.[93] Trade of wives by auctions was also a common practice throughout history. For instance, in the old English custom of wife selling, a wife was divorced by selling her in a public auction for the highest bid.[94] ISIS conducted slave auctions to sell up to 7,000 Yazidi women as reported in 2020.[95][96]

A virginity auction is the voluntary practice of individuals seeking to sell their own virginity to the highest bid.[97] Cricket players are routinely put up for auction, whereby cricket teams can bid for their services.[98][99] Indian Premier League (IPL) started annual public auctioning of cricket players in 2008 as an entertainment for mass consumption.[100] Also, Bangladesh Premier League conducts cricket player auctions, starting in 2012.[101]

Real estate auctionsedit

In some countries, such as Australia, auctioning is a common method for the sale of real estate. Auctions were traditionally used as an alternative to the private sale/treaty method to sell property that, due to their unique characteristics, were difficult to determine a price for. The law does not require a vendor to disclose their reserve price prior to the auction. During the 1990s and 2000s, auctions became the primary method for the sale of real estate in the two largest cities, Melbourne and Sydney. This was largely due to the fact that in a private sale the vendor has disclosed the price that they want, and potential purchasers would attempt to low-ball the price, whereas in an auction purchasers do not know what the vendor wants, and thus need to keep lifting the price until the reserve price is reached.

The method has been the subject of increased controversy during the twenty-first century as house prices sky-rocketed. The rapidly rising housing market saw many homes, especially in Victoria and New South Wales, selling for significantly more than both the vendors' reserve price and the advertised price range. Subsequently, the auction systems' lack of transparency about the value of the property was brought into question, with estate agents and their vendor clients being accused of "under-quoting". Significant attention was given to the matter by the Australian media, with the government in Victoria eventually bowing to pressure and implementing changes to legislation in an effort to increase transparency.[102]

In the UK, historically, auction houses were perceived to sell properties which may have been repossessed - where a home owner fails to make regular mortgage payments - or were probate sales i.e. a family home being sold by the heirs. However, more recently, selling at auction has become an alternative to a normal property sale, due to the speedy nature of the entire process.[103]

In China, land auctions are under the sole control of local government officials. Because some developers may use bribes to please government officials to obtain the right to purchase the land, the central government requires that future land auctions be conducted using a spectrum auction in order to prevent the spread of corruption. Although this method cannot completely solve the problem of corruption, it is still a significant contribution to the auction.[104]

Auctions by authoritiesedit

A government auction is simply an auction held on behalf of a government body generally at a general sale. Items for sale are often surplus needed to be liquidated. Auctions ordered by estate executors enter the assets of individuals who have perhaps died intestate (those who have died without leaving a will), or in debt. In legal contexts where forced auctions occur, as when one's farm or house is sold at auction on the courthouse steps. Property seized for non-payment of property taxes, or under foreclosure, is sold in this manner. Police auctions are generally held at general auctions, although some forces use online sites including eBay, to dispose of lost and found and seized goods. Debt auctions, in which governments issue and sell debt obligations, such as bonds, to investors. The auction is usually sealed and the uniform price paid by the investors is typically the best non-winning bid. In most cases, investors can also place so-called non-competitive bids, which indicates interest to purchase the debt obligation at the resulting price, whatever it may be. Some states use courts to run such auctions. In spectrum auctions conducted by the government, companies purchase licenses to use portions of the electromagnetic spectrum for communications (e.g., mobile phone networks). In certain jurisdictions, if a storage facility's tenant fails to pay rent, the contents of their locker(s) may be sold at a public auction. Several television shows focus on such auctions, including Storage Wars and Auction Hunters.

Commodity auctionsedit

Auctions are used to trade commodities; for example, fish wholesale auctions. In wool auctions, wool is traded in the international market.[105] The wine auction business offers serious collectors an opportunity to gain access to rare bottles and mature vintages, which are not typically available through retail channels. In livestock auctions, sheep, cattle, pigs and other livestock are sold. Sometimes very large numbers of stock are auctioned, such as the regular sales of 50,000 or more sheep during a day in New South Wales.[106] In timber auctions, companies purchase licenses to log on government land. In timber allocation auctions, companies purchase timber directly from the government.[107] In electricity auctions, large-scale generators and distributors of electricity bid on generating contracts. Produce auctions link growers to localized wholesale buyers (buyers who are interested in acquiring large quantities of locally grown produce).[108]

Online auctionsedit

Online auctions are a form of E-commerce that relies on the advantages of a digital platform's ability to overcome geographical constraints, provide real-time information and reduce transaction costs, bringing greater convenience to people and allowing more people to participate as bidders, as well as being able to view a greater selection of auctions.[109] Websites like eBay provide a potential market of millions of bidders to sellers. Established auction houses, as well as specialist internet auctions, sell many things online, from antiques and collectibles to holidays, air travel, brand new computers, and household equipment. Private electronic markets use combinatorial auction techniques to continuously sell commodities (coal, iron ore, grain, water, etc.) online to a pre-qualified group of buyers (based on price and non-price factors).[110] Furthermore, online auctions facilitate the process for prospective bidders to discover and evaluate items by enabling searches across numerous auctions and employing filters to refine their selections.[111]

On the other hand, an alternative perspective suggests that the format of online auctions could also give rise to collusive conduct and other types of market manipulation, potentially skewing the market and diminishing its efficiency.[109] Firstly, online auctions might enable bidders to obscure their identities, such as utilizing pseudonyms or multiple accounts to maintain anonymity. This concealment could simplify collusion without detection.[112] Secondly, online auctions might ease the implementation of collusive arrangements among bidders. The accessibility of bidding data in online auctions, for instance, allows colluding bidders to monitor each other's bids, guarantee adherence to their agreements, and penalize non-compliance. This enhanced oversight capacity strengthens the stability of collusive agreements.[113]

Unique item auctionsedit

- Motor vehicle and car auctions – Here one can buy anything from an accident-damaged car to a brand new top-of-the-range model; from a run-of-the-mill family saloon to a rare collector's item.

- Antiques and collectibles auctions give an opportunity for viewing a huge array of items. The sale of collectibles includes items such as stamps, coins, vintage toys & trains, classic cars, and fine art.[114]

- On-site auctions – Sometimes when the stock or assets of a company are simply too vast or too bulky for an auction house to transport to their own premises and store, they will hold an auction within the confines of the bankrupt company itself. Bidders could find themselves bidding for items which are still plugged in, and the great advantage of these auctions taking place on the premises is that they have the opportunity to view the goods as they were being used, and may be able to try them out. Bidders can also avoid the possibility of goods being damaged whilst they are being removed as they can do it or at least supervise the activity.[115]

- Second-hand goods – For the sale of consumer second-hand goods of all kinds, particularly farm (equipment) and house clearances and online auctions.

- Sale of industrial machinery, both surplus or through insolvency.

- Thoroughbred horses, where yearling horses and other bloodstock are auctioned.[116]

- Travel tickets – One example is SJ AB in Sweden auctioning surplus at Tradera (Swedish eBay).

- Holidays – A variety of holidays are available for sale online particularly via eBay. Vacation rentals appear to be the most common. Many holiday auction websites have launched but failed.[117]

- Mystery auction – An auction where bidders bid for boxes or envelopes containing unspecified or underspecified items, usually on the hope that the items will be humorous, interesting, or valuable.[118][119] In the early days of eBay's popularity, sellers began promoting boxes or packages of random and usually low-value items not worth selling by themselves.[120]

- Some rare CryptoKitties, which are tokens representing virtual cats, have been sold over automated blockchain auctions for more than $200,000.[121]

Other contextsedit

- Charity auctions – Used by nonprofits, higher education, and religious institutions as a method to raise funds for a specific mission or cause both through the act of bidding itself, and by encouraging participants to support the cause and make personal donations. Often, these auctions are linked with another charity event like a benefit concert.[122]

- Insurance policies – Auctions are held for second-hand endowment policies. The attraction is that someone else has already paid substantially to set up the policy in the first place, and one will be able (with the help of a financial calculator) to calculate its real worth and decide whether it is worth taking on. Lloyd's, the world's reinsurance market, runs auctions of syndicate capacity for the underwriting.[123]

- Private treaty sales – Occasionally, when looking at an auction catalog some of the items have been withdrawn. Usually, these goods have been sold by 'private treaty'. This means that the goods have already been sold off, usually to a trader or dealer on a private, behind-the-scenes basis before they have had a chance to be offered at the auction sale. These goods are rarely in single lots – photocopiers or fax machines would generally be sold in bulk lots.

- Environmental auctions, in which companies bid for licenses to avoid being required to decrease their environmental impact. These include auctions in emissions trading schemes.

Bidding strategyedit

Zdroj:https://en.wikipedia.org?pojem=AuctionsText je dostupný za podmienok Creative Commons Attribution/Share-Alike License 3.0 Unported; prípadne za ďalších podmienok. Podrobnejšie informácie nájdete na stránke Podmienky použitia.

Antropológia

Aplikované vedy

Bibliometria

Dejiny vedy

Encyklopédie

Filozofia vedy

Forenzné vedy

Humanitné vedy

Knižničná veda

Kryogenika

Kryptológia

Kulturológia

Literárna veda

Medzidisciplinárne oblasti

Metódy kvantitatívnej analýzy

Metavedy

Metodika

Text je dostupný za podmienok Creative

Commons Attribution/Share-Alike License 3.0 Unported; prípadne za ďalších

podmienok.

Podrobnejšie informácie nájdete na stránke Podmienky

použitia.

www.astronomia.sk | www.biologia.sk | www.botanika.sk | www.dejiny.sk | www.economy.sk | www.elektrotechnika.sk | www.estetika.sk | www.farmakologia.sk | www.filozofia.sk | Fyzika | www.futurologia.sk | www.genetika.sk | www.chemia.sk | www.lingvistika.sk | www.politologia.sk | www.psychologia.sk | www.sexuologia.sk | www.sociologia.sk | www.veda.sk I www.zoologia.sk